Successful on paper. Stressed in practice.

If money stress is hijacking your life—or your business is stuck in the mud—I help you get clear, get honest, and get moving again. We’ll work with your real operating system: personality, fear patterns, leadership reflexes, and the “Money Monsters” that run the show when you’re tired, stressed, or just not paying attention.

Ways I Help

I spent 20 years as a Benedictine monk navigating financial crises and organizational dysfunction—from community bankruptcy to rebuilding systems from scratch. Then I helped grow an investment firm to $260M in assets. I learned that business problems are almost always people problems wrapped in financial statements.

If your career is successful or your business is generating revenue, but you're still stressed about money, if your team is underperforming, or if you know your business model needs an overhaul but don't know where to start, you don't need another consultant deck. You need someone who understands both the numbers and the human psychology driving your decisions.

-

We tackle financial anxiety, avoidance, overspending, under-earning, conflict around money, and the “why do I keep doing this?” loop. Then we build a simple plan you’ll actually follow—without shame.

Money anxiety + decision paralysis

Couples/family money conflict (values + boundaries)

Systems: spending plan, debt strategy, savings habits

Alignment: money as a tool for purpose (not self-punishment)

-

When a venture is wobbling, we stabilize cash, simplify the strategy, and fix the “people + process” bottlenecks. Most founders don’t need motivation—they need clarity and a plan that survives reality.

Pricing, cash flow, runway, “where is it leaking?”

Strategic focus (what to double down on / what to kill)

Founder mindset + leadership patterns under stress

Execution cadence (weekly targets that actually land)

-

Sometimes the problem isn’t your business model—it’s the nervous systems inside the team. We surface the conflict pattern, translate the personalities, and rebuild trust with clear agreements.

Founder/partner conflict mediation

Communication breakdowns + accountability gaps

Culture repair after a hard season

Enneagram-based leadership and collaboration

Who Is This For?

-

Professionals, business owners, or entrepreneurs with significant income but financial stress

You're making money but your financial situation feels chaotic or unsustainable

You're willing to examine hard truths about your finances, business, and behavior

You're ready to make changes between sessions, not just talk about them

You want to understand the why behind dysfunctional patterns, not just apply band-aids

You're open to personality-based work (Enneagram)

-

Business owners who can't separate personal and business finances

High earners who chronically overspend or can't build wealth

Commission-based professionals with variable income stress

Entrepreneurs who underprice or self-sabotage

Anyone with financial avoidance despite having the resources to succeed.

Business owners looking to scale, sell, or turnaround a business

-

You're in a true financial crisis (eviction, foreclosure, bankruptcy without assets)—you need emergency legal/financial services first

You want me to do the work for you rather than coach you through it

You need a therapist, a CFO, CPA, or an investment advisor (those are different services)

You're not willing to look at your actual financial reality or make difficult decisions

If you want a hype coach, a “get rich quick” system, or someone to cheerlead bad ideas—keep scrolling. I’m warm, not fluffy.

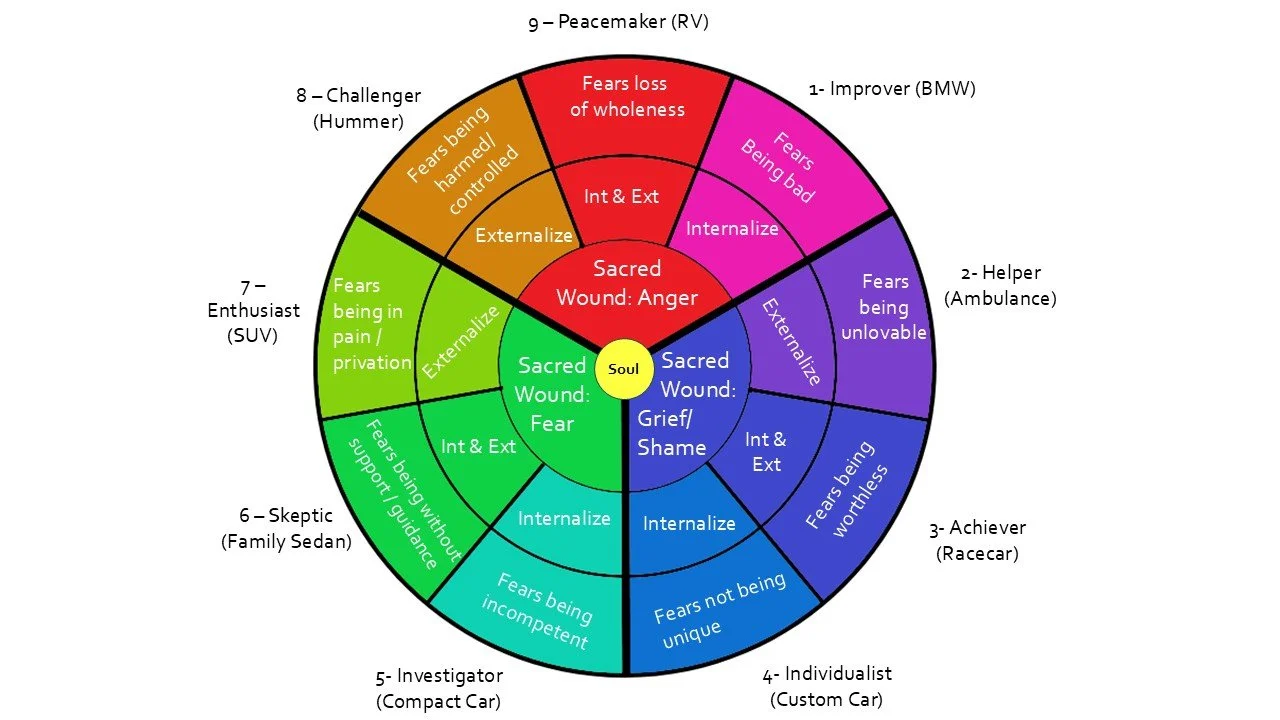

THE ENNEAGRAM ADVANTAGE

Why the Enneagram changes everything

Most money advice fails because it treats people like spreadsheets. But money behavior is personality behavior—especially under stress.

In this work, your Enneagram type becomes a diagnostic map:

what you do when you feel unsafe

what you avoid or get anxious about

how you justify it

how you sabotage yourself (with style)

and how you build strength without changing who you are

What We’ll Do

Structure

Duration: 3-month engagement, for Options A & B (6 bi-weekly sessions) or Option C: (12 weekly sessions and 2 group sessions per month)

Format: 60-minute or 75-min video calls

Between sessions: Assignments, tracking, accountability check-ins

We get brutally honest about what's really going on.

First, we identify your Enneagram type and map your money/leadership patterns—what you do under stress, what you avoid, how you justify it, and how you sabotage yourself. Then we audit the actual numbers (personal finances, business financials, or team dynamics depending on your package) and identify the gap between where you are and where you need to be.

By the end of Month 1, you have a clear strategy: a financial system, business model restructure, or team communication framework that actually fits how you operate—not some generic template you'll abandon in two weeks.

Month 1

Diagnosis & Strategy

We execute the plan and handle the friction as it shows up.

This is where theory meets reality. You're running the new system, and we're troubleshooting in real time: Why did you blow past your spending limit? Why is the pricing conversation with that client making you want to hide? Why is your co-founder still doing that thing that drives you crazy?

We don't just talk about what should work—we fix what's actually breaking. You'll have weekly metrics (depending on your package), accountability check-ins between sessions, and practical scripts for the hard conversations you've been avoiding.

Month 2

Implementation & Troubleshooting

We make it stick.

By now, you've got momentum. Month 3 is about refining the system based on real results, addressing lingering resistance, and building the habits that keep this working after our engagement ends. We create your maintenance plan—the minimum effective dose of effort required to sustain progress without burning out.

You leave with clarity, a proven system, and the self-knowledge to catch yourself before old patterns take over again.

Month 3

Integration & Sustainability

PACKAGES & PRICING

Pricing note: I keep a limited number of reduced-rate slots for mission-driven work. Ask if you’re a nonprofit founder, educator, or in a genuine rebuild season.

The 3-D Enneagram

-

$997 / month (or $2,697 paid in full)

Includes:2× 60-min sessions/month

Money Monster + behavior plan

Spending/saving system + “next right steps”

Light async support (voice note/email) between sessions

Best for: personal finances, anxiety, avoidance, values alignment.

-

$1,997 / month (or $5,397 paid in full)

Includes:2× 75-min sessions/month

Business financial triage (cash, runway, pricing, offers)

90-day execution plan + weekly scorecard

“Hard conversation” prep scripts + decision support

Light async support between sessions

Best for: founders, stuck ventures, messy priorities.

-

$4,997 / month (or $13,497 paid in full)

Includes:Weekly 60-min leadership sessions (1:1)

Plus 2× team sessions/month (75–90 min)

Conflict mapping + communication agreements

Role clarity + accountability system

Optional Enneagram team debrief

Best for: leadership teams, partner conflict, culture drift. Limited Availability - book discovery call to discuss.

-

$1,997 (3.5 hours, virtual)

Includes:Pre-work intake + documents review

Live intensive

Written action plan + 30-day roadmap

Best for: “I need traction now.”

Frequently Asked Questions

-

No. If you do, great. If not, we’ll figure it out quickly enough.

-

No—this is coaching. It’s practical and emotionally intelligent, but it’s not clinical treatment. If you need trauma work, addiction treatment, or clinical mental health support, I'll refer you to appropriate professionals.

-

Yes. Many founders don’t have two separate nervous systems.

-

Virtual by default. In-person intensives available depending on schedule.

-

Book the half-day intensive. It’s designed for “we need clarity this week.”

-

That's fine. I've worked with people who hadn't looked at their bank statements in months, business owners with no idea of their actual profitability, and complete financial chaos. Shame and avoidance are part of what we'll address.

-

Yes. I recommend involving spouses for personal finance issues and key team members or business partners when relevant. Additional sessions available for couples work or team facilitation.

-

We can extend month-to-month after the initial engagement. Some transformations require 6-12 months, but we'll see significant progress in the first 3 months regardless.

-

I don’t offer financing beyond the monthly retainer. Sessions are paid monthly in advance (or pay-in-full discount)

-

You can reschedule a session with 24 hours notice. Same-day rescheduling counts as using that day’s session.

-

Yes, if needed. I treat all client information as confidential regardless, but I'm happy to formalize that if required.

Ready for a healthier relationship with money—and a stronger business?

Or, please fill out the Contact Form and note that you are a prospective coaching client.